The timeless symbol of wealth and prosperity is in your pocket now. You no longer need a bank wallet or a treasure chest to unlock the potential of gold. Just pull up your mobile and start trading gold online. This article will guide you 1) easy steps to start gold trading; 2) gold trading strategies; 3) market analysis for gold trading; 4) risk management rules and 5) Key factors affecting the gold market.

Contents

What is Forex Gold Trading?

Forex Gold trading involves speculating on the price movements of gold without physically owning the metal. Instead of buying and selling physical gold, traders enter into contracts or derivatives, such as contracts for difference (CFDs) or gold futures, which mirror the price of gold. The goal is to profit from the fluctuations in the price of gold by buying low and selling high or selling high and buying back at a lower price.

How to Start Forex Gold Trading Online?

Step1: Choosing a Reliable Online Broker & Account Opening

To start trading gold online, it is essential to choose a reputable online broker. Look for brokers that are regulated and offer a user-friendly trading platform with competitive pricing, reliable customer support, and a range of trading tools and resources.

Once you have selected a broker, you will need to open an account. This typically involves providing personal information and completing the necessary verification process as required by regulatory authorities.

Step 2: Fund Your Trading Account

After opening your account, you will need to fund it to start trading. Most online brokers offer various deposit options, including bank transfers, credit/debit cards, and e-wallets. Choose the method that suits your preferences and deposit the desired amount into your trading account.

Step 3: Analyze the Gold Market & Develop a Trading Strategy

Analyze market trend and define your plan to trade in the prevailing market trend. Your plan should include buying and selling price, stop loss, and position size.

Step 4: Execute Trades

Start buying and selling gold according to the plan developed in the previous step.

Best Forex Gold Trading Strategies

- Trend following: It involves identifying gold price trend and riding until the trend fades away.

- Breakout trading: Entering trades when the price breaks out of a strong support/resistance, defined range or technical chart pattern.

- Swing trading: Swing trading focuses on capturing medium-term price movements in the gold market. You aim to identify trends or price reversals and enter positions that take advantage of these price swings.

- Mean reversion: Gold price fluctuates around the weighted mean price or moving average. You can buy gold when its price drops significantly below the moving average and sell when it goes far greater than its moving average.

Gold Market Analysis for Trading

There are two types of analysis for the gold market;

A. Fundamental Analysis

Fundamental analysis involves evaluating economic factors, geopolitical events, and market trends that can impact the price of gold. This analysis includes:

- Gold supply and demand: Analyzing factors affecting the supply and demand dynamics of gold.

- Macroeconomic indicators: Studying economic data to understand the overall health of economies and their impact on gold prices.

- Central bank policies: Monitoring central bank decisions and their influence on gold markets.

- Geopolitical events: Assessing geopolitical risks and their potential impact on gold prices.

- Mining industry analysis: Evaluating the financial health, production capabilities, and exploration efforts of gold mining companies.

B. Technical Analysis

Technical analysis focuses on studying historical price patterns, chart patterns, and various technical indicators to predict future price movements. Use technical analysis tools to identify;

- Trend direction

- Support and resistance levels

- Entry and exit points

Many traders use technical indicators like RSI, MACD or Moving Average Cross to identify market trend.

Key Drivers of the Gold Market

- Supply and demand: The balance between the supply of gold and the demand for it plays a crucial role in determining its price.

- Central bank policies: Monetary policies and actions of central banks, such as buying or selling gold reserves, can impact the gold market.

- Geopolitical factors: Political tensions, economic stability, and global events can affect gold prices.

- Investor sentiment: Market sentiment and investor behavior can cause fluctuations in gold prices.

- Interest rates: Changes in interest rates, especially real interest rates, can impact gold prices.

- Currency fluctuations: Gold prices are inversely correlated with currency values. A weaker currency often leads to higher gold prices.

Risk Management in Gold Trading

Risk management is crucial in forex gold trading to protect your capital and minimize losses. Always follow these 4 rules to manage risk in gold trading:

- Maintain Risk to Reward: Always Maintain Risk to Rewards ratio at 1:3.

- Set appropriate stop-loss: Set a carefully selected stop loss to limit potential losses.

- Use appropriate position sizing: Adjust the size of your positions based on your risk tolerance and account size.

- Keep leverage in check: Be cautious when using leverage, as it amplifies both gains and losses.

Tips for Successful Forex Gold Trading

- Maintain discipline: Stick to your trading plan and avoid emotional decision-making.

- Stay informed: Keep track of the latest news, market trends, and economic indicators that impact gold prices.

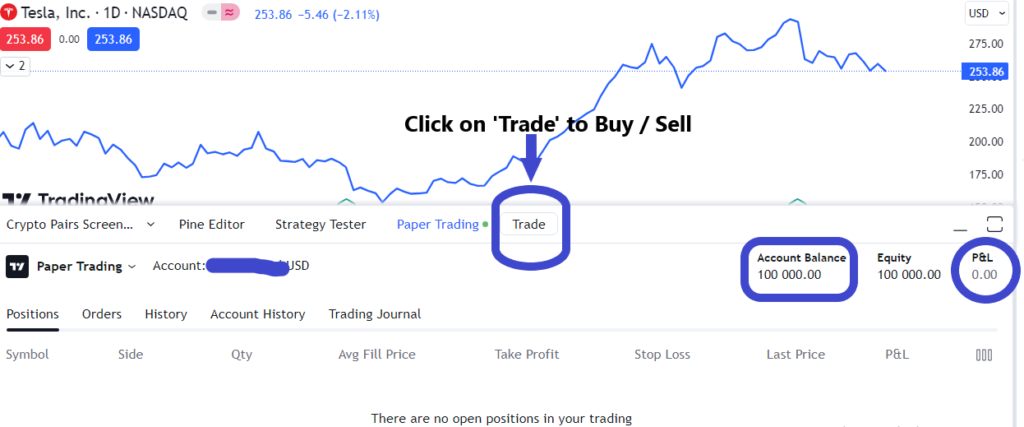

- Utilize demo accounts: Practice trading strategies and familiarize yourself with platforms using virtual accounts.

End Note

Forex Gold trading offers an exciting opportunity to capitalize on the price movements of this precious metal. By understanding the fundamentals of gold trading, implementing effective strategies, and practicing sound risk management, you can navigate the market with confidence. Remember to stay updated with market trends and continuously educate yourself to adapt to changing conditions.

With dedication and perseverance, you can unlock the potential of forex gold trading and achieve your financial goals.

FAQs

How do you trade in gold?

- Open an account in a reliable gold trading platform 2. Fund your account 3. Develop Strategy 4. Execute Trades

Can I trade gold with $10?

Yes. Some gold trading platforms allow you to trade with even $10 in your account.

Is gold trading profitable?

Gold trading is profitable if you follow a robust trading strategy with a sound trading mindset.