If you’ve ever dreamed of becoming a skilled trader, but the fear of losing your hard-earned money has held you back, then paper trading is the perfect solution for you. Imagine being able to practice trading strategies, explore the market’s dynamics, and hone your skills—all without risking a single penny. In this article, we will dive into the world of paper trading, where virtual meets reality, and guide you through the necessary steps to develop your trading prowess.

Contents

What is Paper Trading?

Paper trading is a practice that allows you to simulate the process of buying and selling financial instruments at real-time market prices without using real money. Instead of risking actual capital, you use virtual funds to execute trades and monitor your performance.

Top 6 Paper Trading Apps / Platforms:

After knowing what is paper trading, definitely you are thinking about where to do it. 6 best paper trading apps / platforms offering free paper trading are listed below;

- Investopedia Stock Simulator

- Thinkorswim Paper Trading

- WeBull Paper Trading

- TradingView Paper Trading

- MetaTrader 4

- Interactive Brokers Paper Trading

How to Start Paper Trading?

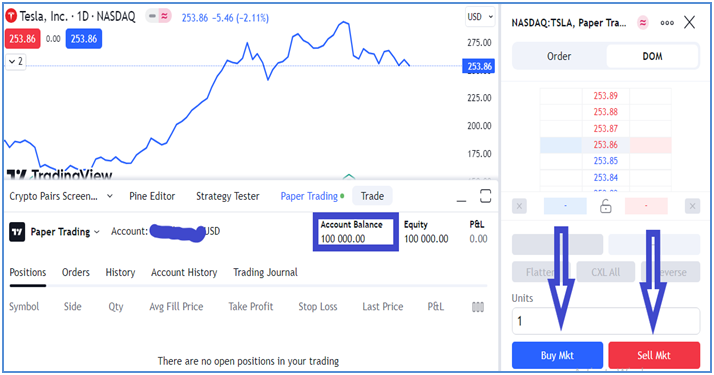

Paper trading is typically done through a trading platform or application that provides a simulated trading environment. You are provided access to real-time market data, price charts, and other trading tools to mimic real market conditions. The trades executed during paper trading are recorded and tracked, allowing you to assess the success or failure of your strategies.

Necessary Steps for Paper Trading:

- Choose a Reliable Trading Platform: Select a reputable trading platform that offers a paper trading feature. Ensure that it provides a realistic simulation of the market and offers the tools and resources you need for analysis.

- Create a Paper Trading Account: Open a free paper trading account through sign up on your chosen platform. This will grant you access to virtual funds and the trading environment.

- Set Virtual Capital: Determine the amount of virtual capital you want to start with. It’s advisable to simulate a capital size that aligns with your real trading goals and risk tolerance.

- Define Trading Parameters: Establish the parameters for your paper trading, such as

- Time frame for Trading; 1 day, 1 hr, or 15 min, etc.

- Trading instruments; Stocks, Forex, Crypto

- Analyze Market and Develop Trading Strategy: Determine market trend and construct support and resistance levels. Develop your trading strategy by clearly mentioning

- Position size

- Entry price

- Exit price

- Stop loss

- Execute Trades: Start executing trades using the virtual funds available in your paper trading account. Place the Buy/Sell order according to the plan laid down in the previous step.

- Analyze and Adjust: Monitor the performance of your trades and keep track of important metrics such as profit/loss, win rate, and risk-reward ratio.

Benefits of Paper Trading

- Risk-Free Environment: Since no real money is involved, you can experiment with different trading techniques, test new strategies, and gain confidence without the fear of incurring financial losses.

- Learning Experience: Paper trading offers a valuable learning experience for beginners. It allows you to understand how the market works, learn about different financial instruments and familiarize yourself with trading platforms and tools.

- Strategy Development: Paper trading provides you an opportunity to develop and refine your trading strategies. By testing various approaches and analyzing the results, you can identify what works and what doesn’t without risking real money.

Paper Trading vs. Real Market Trading:

Although paper trading offers valuable opportunities for beginners to practice trading without losing their money, it has some limitations when compared to real market trading where trading psychology comes into play.

- Emotional Factors: Real trading involves real money, which can evoke emotions such as fear and greed. Controlling emotions and making rational decisions can be a daunting challenge when actual financial stakes are involved.

- Market Liquidity and Slippage: Paper trading may not accurately reflect the liquidity and slippage experienced in real market conditions. You need to adapt to the actual market environment and be prepared for price discrepancies.

- Psychological Pressure: The psychological pressure of managing real money can be overwhelming for some traders. It’s essential to develop the right trading mindset and manage emotions effectively to avoid impulsive decision-making.

- Risk Management: While paper trading provides a risk-free environment, real trading requires strict risk management. You must implement appropriate risk management strategies to protect your capital and prevent significant losses.

What you should Accomplish From Paper Trading?

- Test basic principles of technical analysis i.e. market behavior near support/resistance and trend lines.

- Evaluate which technical indicators and moving averages best suit your equity instruments.

- Develop criteria for entering a trade.

- Practice executing trade plan religiously and don’t change the entry price, exit price, and stop loss.

- Build a habit of maintaining a trading journal.

End Note

Knowing what is paper trading and practicing on the right platform can be the first step for the persons aspiring to start the trading journey.

Paper trading serves as a valuable tool to gain experience, develop essential skills, test strategies, and build confidence in the trading world. By simulating trades without real money, you can learn the intricacies of the market and fine-tune your trading strategies. You can navigate the equity markets more efficiently and make informed trading decisions if you practice paper trading.