One of the easiest and most reliable trading approaches is to trade the ongoing price action of the equity chart. Its accuracy in analyzing complex equity markets has captured the focus of many traders. It relies on decoding past price behavior and predicting the future market direction based on past behavior.

This article describes easy steps for price action analysis of equity charts enabling you to successfully identify potential trades. It also enlists useful price action trading secrets and strategies.

Contents

What is Price Action Trading?

It is a trading approach that relies on the analysis of historical price movements to anticipate future price direction. It is based on the logic that

- price behavior at a level is identical to its previous behavior at that level

- all the information relevant to the market is reflected in the price itself

By closely studying the patterns, formations, and behavior of price on charts, you aim to identify recurring patterns, support and resistance levels, and other critical market dynamics that can help predict future price movements.

How to Trade Price Action?

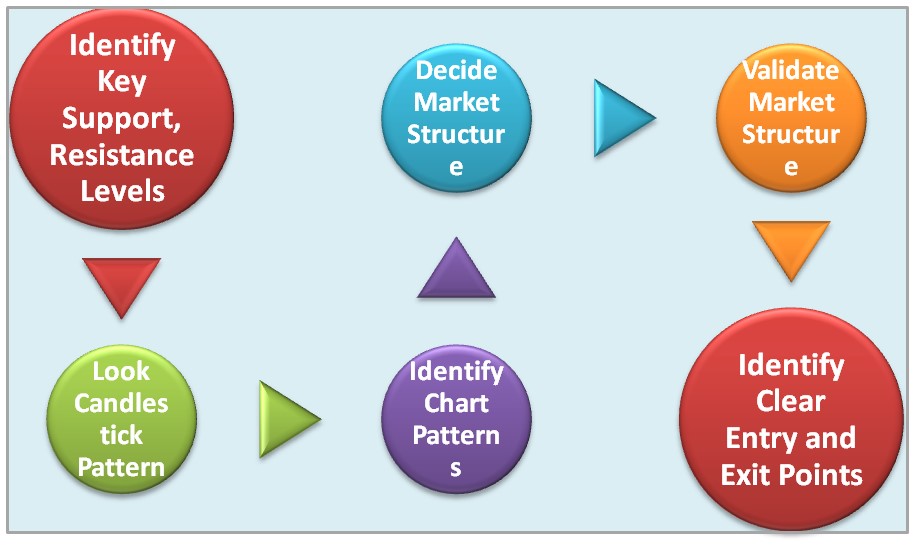

For price action trading, follow these 6 steps:

Step1 Identify Key Support and Resistance Levels:

Start by identifying significant support and resistance levels on the price chart. These levels act as important reference points and guide your trading decisions.

Step2 Recognize Candlestick Patterns:

Know the implications of various candlestick patterns and critically look at price chart for identification of recent candlesticks or patterns formed. They provide insights into market sentiment and potential reversals.

Identify and interpret common price action patterns such as engulfing candles, pin bars, inside bars, doji candle, morning and evening shooting star, hammer, dark cloud cover, piercing line formation etc.

Step 3 Identify Chart Patterns:

Identify chart patterns such as triangles, head and shoulders, and double tops or bottoms, which can indicate potential price reversals or continuations.

Step 4 Decide Market Structure:

Evaluate the market structure by identifying trend. Classify it as either a trending market or range bound market. This analysis helps determine the overall context and potential trading strategies.

Step 5 Validate Market Structure Through Volume Analysis:

Analyze trading volume in conjunction with price action to gauge the strength of market movements. If trading volume increases with the progression of a trend, the market structure is strong. A diminishing trading volume in a trending market reflects a weak structure.

Step 6 Identify Clear Entry and Exit Points:

Define specific entry and exit rules based on your analysis i.e. after breakout of support/resistance, chart pattern, or particular candle formation. Also, determine the right time to enter a trade as well as stop-loss and profit targets.

Popular Price Action Trading Strategies:

1. Breakout Trading:

It is the most attractive price action trading strategy. It involves entering a trade when the price breaks above a significant resistance level or below a significant support level.

2. Pullback Price Action Trading:

With this strategy, you wait for the price to retrace or “pull back” to a key support or resistance level after a strong trend. Then enter trades in the direction of the overall trend.

3. Trend Following:

It involves identifying a trend by constructing a trend line or moving average. For an uptrend, take a buy position and carry the position until the trend abolishes_ as evident from the trend line breakout.

4. Range Trading:

Range trading is done when the price bounces between established support and resistance levels (horizontal or slanted). You buy at support and sell at resistance.

Benefits of Price Action Trading

- Simplicity: It focuses on analyzing pure price movements, making it a straightforward and intuitive approach. You can avoid complex indicators and rely on your observation skills.

- Real-Time Decision Making: Since price action analysis is based on current and historical price movements, you can make decisions in real-time without lagging indicators or delayed information.

- Adaptability: This trading strategy can be applied to any financial market, including stocks, forex, commodities, and cryptocurrencies. The principles remain the same, regardless of the asset class or timeframe.

- Enhanced Risk Management: You can effectively manage risk by placing stop-loss orders based on key support and resistance levels, minimizing potential losses.

- Developing Trading Discipline: It encourages you to rely on your own analysis and judgment. This helps develop discipline, patience, and emotional control, which are essential qualities for successful trading.

End Note

Price action analysis is a powerful and versatile approach that allows you to harness the secret information in price charts. It enables you to successfully analyze market behavior and choose the right entry and exit points for a trade. Even a beginner can successfully identify profitable trades by practicing the price action trading secrets.

Moreover, price action analysis offers you a deeper understanding of market dynamics and improves your trading performance. Whether you are a novice trader or an experienced professional, incorporating price action analysis into your trading arsenal can enhance your skills and increase your chances of success.

FAQs:

- What are price action trading secrets?

Sometimes the market behaves in a particular way to form certain patterns known as trading chart patterns like head and shoulder, triangle and wedge etc. These are termed Price action trading secrets and price action analysis decodes these secrets.

- What is a price action in trading terms?

It is the behavior of market at various price levels. Traders analyze this behavior through the price action analysis steps mentioned above.

- Is price action trading profitable?

Yes, price action can be profitable if you do it after thorough practice with proper money management techniques, and through the right trading psychology.