“A bird in hand is worth two in the bush” is true for equity markets if we replace bird with cash. Stop loss order is a wonderful tool to keep your cash in hand in equity markets.

An optimum stop loss not only preserves your capital when a trade goes against your position but it also preserves profits after a trade goes in your favor. But how to set an appropriate stop loss order in trading? This article is created for this purpose. It elaborates stop loss order, its types, strategies to set stop loss order, and special tips for choosing the right stop loss order.

Contents

What is Stop Loss Order?

A stop loss is an order that automatically sells a security when its price reaches the level of stop-loss. It is used to limit potential losses by pulling you out of a trade when the price moves against your trade position. By setting a stop loss, you can protect yourself from adverse movements in the market and ensure that losses are contained within predetermined limits.

How Does a Stop-Loss Order Work? Example

Imagine you buy a stock at $50 per share, but you want to limit your loss to 5%. You can set a stop loss order at $47.50. If the stock’s price drops to $47.50 or below, your broker will execute a market order to sell the stock, protecting you from further losses.

Types of Stop Loss Orders

- Market Stop Loss: This is the most common type of stop loss order. It is executed at the prevailing market price once the specified price level is reached. Market stop loss orders guarantee execution but do not guarantee the exact price at which the trade will be executed.

- Limit Stop Loss: With a limit stop loss order, you can specify the minimum price at which they are willing to sell their securities. If the market reaches the stop price or trades below it, the order becomes a limit order and is executed at or better than the specified price.

- Trailing Stop Loss: A trailing stop loss order is dynamic and adjusts with the price movement of the security. It is set at a certain percentage or dollar amount below the current market price. As the price rises, the trailing stop follows, always maintaining the specified distance. However, if the price falls, the stop loss remains unchanged.

Stop Limit vs Stop Loss Order:

Stop Loss and Stop Limit are both order types used in trading to manage risk and automate trade executions. However, there are key differences between the two. Let’s explore them:

Stop Loss Order

A stop loss order is an instruction to sell a security when its price reaches or falls below a specified level, known as the stop price. It is designed to protect traders from significant downward moves in the market. The execution of a stop loss order is not guaranteed at a specific price. Once the stop price is hit, the order is converted into a market order, and the trade is executed at the best available market price, which may differ from the stop price.

Stop Limit Order

A stop limit order combines elements of both stop loss and limit orders. It involves setting two price levels: the stop price and the limit price. When the stop price is reached, the stop limit order is triggered and becomes a limit order to buy or sell a security at the specified limit price or better.

Techniques for Setting Stop Loss

- Percentage-based Stop Loss: One technique is to set a stop loss based on a percentage of the security’s price. For example, a trader might choose to set a stop loss at 5% below the entry price. This technique allows for some flexibility while considering the price volatility of the security.

- Support and Resistance Levels: Another technique is to set a stop loss based on key support and resistance levels on the chart. Support levels are price levels where buying pressure is expected to be strong, while resistance levels are price levels where selling pressure is expected to be strong. Placing a stop loss just below a support level can help protect against significant downward moves.

- Volatility-based Stop Loss: Volatility can greatly impact a security’s price movement. You can adjust the stop loss levels based on the volatility of the security. For highly volatile securities, wider stop loss levels may be appropriate to account for larger price swings, while for less volatile securities, tighter stop loss levels may be effective.

Best Stop Loss Strategies for Various Trading Plans:

1. Stop Loss for Range Trading:

Put stop loss order outside of price range or channel on either side i.e. while buying long, place stop loss below the lower line of price range, and for short selling, place stop loss a few points/pips above the upper line of price range.

2. StopLoss for Trend Trading:

For an upward-trending market, place stop loss order below the trend line. In a downward trending market, construct a trend line by connecting the successive lower peaks and place stop loss above the trend line. For ease of use, you can put stop loss order below the moving average for up up-trending market and above the moving average for down down-trending market.

3. Stop Loss for Swing Trading:

Usually, stop loss in swing trading is placed below the recent low while trading on long side. On short selling, stop loss order is placed above the recent price peak.

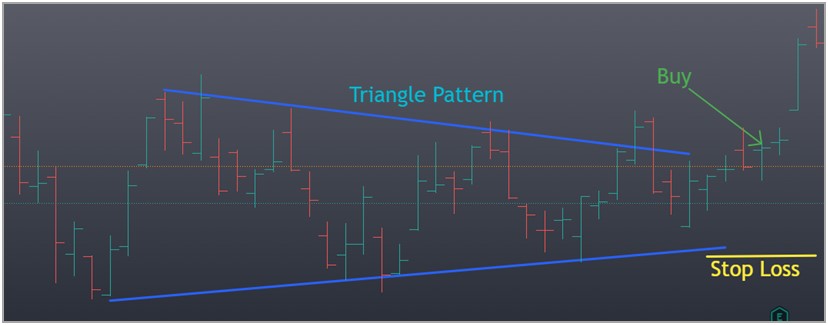

4. Stop Loss for Technical Chart Pattern Trading:

For a triangle, place stop loss opposite to the breakout direction i.e. if a triangle is broken up side, place stop loss below the lower line. A similar is true for wedge.

For head and shoulder, place stop loss above the neckline during top formation and below the neckline during bottom formation through inverse head and shoulder.

How to Set an Optimum Stop Loss?

Step 1 Define Your Risk Tolerance:

Before placing a stop loss order, determine your risk tolerance based on your trading strategy, account size, and risk appetite. This will help you set appropriate stop-loss levels.

Step 2 Consider Market Volatility:

Take into account the volatility of the market and the specific instrument you are trading. Higher volatility may require wider stop-loss distances to avoid premature exits.

Step 3 Use Technical Analysis to Finalize:

Combine your stop-loss strategy with technical analysis tools such as support and resistance levels, trend lines, and indicators to refine your decision-making process. You can use Fibonacci retracement levels to decide your stop loss.

Step 4 Adjust Stop Loss as the Trade Progresses:

As the price moves in your favor, consider adjusting your stoploss to lock in profits or trail the price to protect a portion of your gains.

Common Mistakes to Avoid While Setting a Stop Loss Order

- Placing Stop Loss Orders Too Tight: Too close to the entry point can lead to premature exits.

- Placing Stop Loss Orders Too Wide: A wide stop loss can expose you to more significant losses if triggered.

- Ignoring Market Conditions: Volatile markets might require wider stoploss levels.

- Not Adjusting Stop Loss Orders: As trade moves in your favor, consider adjusting your stop loss to lock in profits.

Nature of Stop Loss Orders for Various Equity Markets

- Stop Loss in Stock Market: A tight and historical price-level-based stop loss is beneficial in managing risk and protecting stock investments from significant price declines.

- Stop Loss Crypto: A loose stop loss serves best in the crypto market. Due to high volatility, tight stop loss results in premature execution and exit from the market.

- Stop Loss in Forex Market: For Managing currency pairs’ volatility and unexpected news events, a tight stop loss is required in the forex market.

Tips for Using Best Stop Loss

- Set Realistic Stop Loss Levels: Determine stop loss levels based on careful analysis. Take into account factors such as support and resistance levels, volatility, and market trends. Avoid setting stop losses too tight or too wide, ensuring they are appropriate for the specific security and market conditions.

- Trail Your Stop Loss: Adjust your trailing stop loss order whenever the market moves in your favor.

- Use Partial Stop Loss Order: Employ a strategy of taking partial profits while moving your stop loss to breakeven or a more favorable level. This allows you to secure profits and reduce the risk of losing the entire trade.

- Use Technical Indicators to Decide Stop Loss: Combine stop loss orders with technical indicators to improve your trade decisions. Indicators such as moving averages, trend lines, or chart patterns can help determine optimal stop-loss levels based on market conditions and price action.

- Avoid Arbitrary Stop Loss Levels: Base your stop loss levels on objective criteria rather than arbitrary numbers. Use technical analysis tools, such as moving averages, trend lines, or chart patterns, to identify key levels for placing stop loss.

- Set Stop Loss Order Beyond Obvious Numbers: For example, if market support lies at 100, put your stoploss below 100 i.e. 99.7.

- Consider Volatility and Liquidity: Take into account the volatility and liquidity of the security you’re trading. Highly volatile stocks may require wider stop-loss levels to account for price fluctuations. On the other hand, illiquid stocks may require tighter stop-loss levels to ensure an orderly execution.

- Practice Risk Management: Stop loss orders should be part of a comprehensive risk management strategy. Determine your risk tolerance and ensure that your stop loss levels align with your overall risk management plan.

Stoploss Hunting

A deliberate market move to hit and trigger the most obvious stoploss levels is termed as stoploss hunting. Large position holders hunt stop loss to further enhance their holding. The most obvious stop loss levels are famous resistance or a whole number like $90 or $100.

To avoid stop loss hunting, it’s advised to put a stop loss order beyond obvious price levels.

Take Profit vs Stop Loss

While a stop-loss order limits potential losses, a take-profit order locks in profits by automatically selling at a predetermined price level.

End Note

In the intricate dance of trading, the stop-loss order is your partner in risk management. It’s a powerful tool that ensures you remain in control even when markets turn turbulent. By implementing effective stop loss strategies, you not only protect your investments but also cultivate a disciplined and strategic approach to trading. Opt above mentioned stoploss setting strategies and securely grow your capital.