A small concept can save your throusands in trading. It is a “pip”. What exactly is a pips and why is it important in forex trading? In this article, we will clarify the concept of a pip and explore its significance in the financial markets.

What is a Pip?

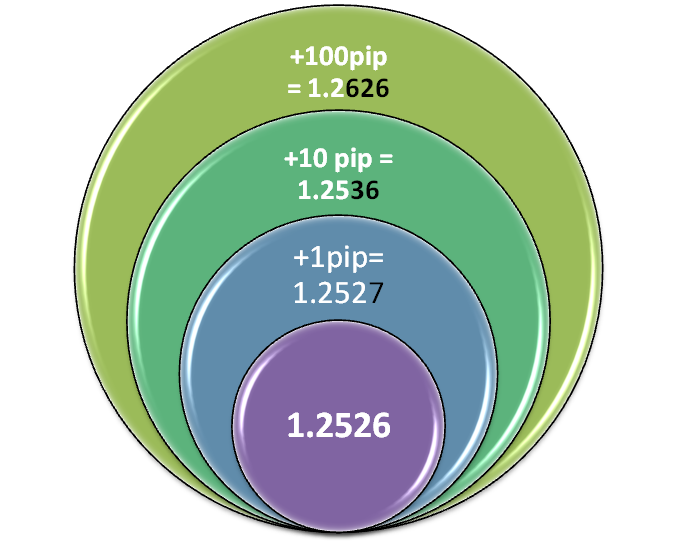

A pip represents the smallest incremental price movement in a currency pair. It is commonly used to measure the change in the exchange rate of two currencies. In forex market, most of the currency pairs are quoted with four or five decimal places, except for the Japanese Yen pairs, which are quoted with two decimal places. In most cases, a pip refers to the fourth decimal place in currency pairs.

For example, if the EUR/USD currency pair moves from 1.2500 to 1.2501, it is said to have moved one pip. Currency pairs involving the Japanese Yen are quoted with two decimal places, so a pip in such pairs would be 0.01.

Calculating Pip Value

The value of a pip depends on the currency pair being traded and the lot size of the trade. In forex trading, a standard lot represents 100,000 units of the base currency, a mini lot represents 10,000 units, and a micro lot represents 1,000 units. The formula to calculate the pip value is as follows:

Pip Value = (One Pip / Exchange Rate) * Lot Size

Let’s consider an example to illustrate this calculation. Suppose you are trading the EUR/USD currency pair, and the exchange rate is 1.2500. If you are trading one standard lot (100,000 units), the pip value can be calculated as follows:

Pip Value = (0.0001 / 1.2500) * 100,000 = $8

This means that for every pip movement in the EUR/USD pair, the value of your trade will change by $8.

Significance of Pips in Trading

Pips are vital in determining the profit or loss of a trade. They help you in measuring the volatility and potential gains or losses in a currency pair. Additionally, pips play a crucial role in setting stop-loss and take-profit levels. You can use pips to determine risk-reward ratio and calculate the appropriate position size for a trade.

It is worth noting that the value of a pip can vary depending on the currency pair and the account denomination. When trading exotic currency pairs or cross pairs, the pip value may be different due to variations in exchange rates and currency conversions.

In practical terms, a movement of a few pips might seem insignificant, but in the forex market where trades are executed in large volumes, even a small change can have a substantial impact on profits or losses.

End Note

Understanding what a pip is and how it is calculated is fundamental to forex trading. A pip represents the smallest price movement in a currency pair and is used to measure changes in exchange rates. By knowing the value of a pip, you can accurately assess your potential profits or losses and manage risk effectively. Whether you are a beginner or an experienced trader, grasping the concept of pips will undoubtedly enhance your understanding of the forex market and aid in making informed trading decisions.