Are you ready to supercharge your trading skills without risking a single dime? Imagine honing your strategies in a risk-free environment, where every decision you make is a step toward trading mastery. You can do this through paper trading on the Tradingview platform. This article serves as an easy guide on how to start paper trade on the TradingView platform.

Contents

What is Paper Trading?

At its core, paper trading is a simulation of live market trading without involving real money. Price quotes (like Bid price, offer price) are real but the capital used to buy or sell is dummy. Your trading profit and loss are also reflected in the virtual currency.

So, it’s a risk-free playground where you can learn trading, try various trading strategies, and refine them. A plus point is ‘paper trading on Tradingview.com is free of cost’.

3 Easy Steps to Start Paper Trading on TradingView

I. Create an Account:

If you don’t already have a TradingView account, sign up for free by using an email or Facebook account.

II. Select a Chart:

Choose the asset (stock, forex pair, crypto, etc.) you’re interested in trading and open its chart.

III. Initiate Paper Trading Mode:

Click the trading panel and select ‘Paper Trading’ as shown in the figure below.

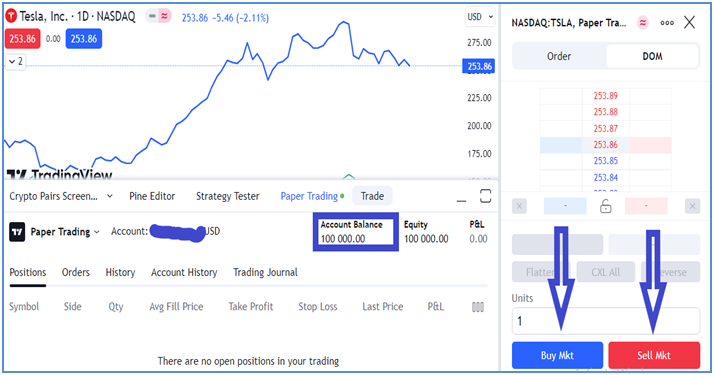

After selecting paper trading, click on ‘Trade’. A real-time trading panel screen will appear.

Once you’re in a paper trading mode, you’ll notice that the trading interface closely resembles the real trading environment. Your account shows a virtual balance with which you can place Buy/Sell orders at real-time market prices. The panel also shows your trade positions and trading history.

Key Benefits of Paper Trading at Tradingview:

- Developing and Testing Trading Strategies

Paper trading is a breeding ground for experimentation. Try out different trading strategies, from day trading to swing trading, and assess their effectiveness. Tradingview allows you to apply technical analysis tools. Apply your charting skills and check their outcomes.

- Analyzing Performance and Fine-Tuning Strategies

After executing several virtual trades, take the time to review your performance. Identify strengths and weaknesses in your strategies and make necessary adjustments.

Prominent Features of Tradingview Paper Trading:

- Variety of Assets: You can practice trading across a wide range of asset classes, including stocks, forex, cryptocurrencies, commodities, and more.

- Advanced Charting Tools: TradingView Paper Trading offers access to the platform’s comprehensive charting tools and technical indicators. You can use these tools to analyze price trends, patterns, and make informed trading decisions.

- Tradingview Mobile App: You can do paper trading on tradingview mobile app for convenience.

- Customizable Strategies: You can implement and test your own trading strategies in the paper trading environment.

- Portfolio Tracking: You can manage a virtual portfolio and track its performance over time. This helps you assess the effectiveness of your trading strategies and make necessary adjustments based on their results.

- Order Types: Tradingview paper trade account supports various order types, including market orders, limit orders, and stop orders. You can practice placing and executing these orders to understand their impact on trades.

- Historical Data Replay: You can use historical data replay to test your strategies against past market movements. This feature enables you to evaluate how your strategies would have performed in different market conditions.

- Social Interaction: TradingView’s platform includes a social aspect where you can share your virtual trades and strategies with the community.

The Real Challenge: Transitioning from Paper Trading to Live Trading

Once you’ve gained confidence and consistency in your paper trading endeavors, you might consider transitioning to live trading. However, remember that live trading involves real risks and emotions like fear, greed, etc which may deteriorate rational decision-making.

For successful live trading, a trader should practice paper trading to the extent that sticking to the trading plan becomes a habit.

Common Pitfalls to Avoid in Paper Trading

- Overtrading: Treating virtual funds carelessly can lead to poor trading habits.

- Ignoring Emotions: Paper trading lacks the emotional component of real trading. Be aware of this disconnect.

- Neglecting Risk Management: Even though it’s virtual money, practicing proper risk management is crucial.

Conclusion

In conclusion, paper trading on TradingView is a priceless tool for traders of all levels. It’s a playground for honing skills, testing strategies, and building confidence without incurring real losses. It enables you to transform theory into practice and gain confidence. By harnessing the power of paper trade, you pave the way for a successful trading journey. So, don’t wait – log in, practice, and watch your skills skyrocket. Your future as a pro trader starts here. Happy trading!