Forex trading offers individuals the opportunity to participate in the global currency markets and potentially profit from currency fluctuations. If you’re new to forex trading and eager to know how to start forex trading, this article will provide you with the essential steps. From understanding the basics to developing a trading strategy, let’s explore the path to becoming a forex trader.

Contents

- 1 How to Start Forex Trading?

- 1.1 Step 1: Educate Yourself about Forex Markets

- 1.2 Step 2: Choose a Reliable Forex Broker

- 1.3 Step 3: Open a Trading Account

- 1.4 Step 4: Learn the Basics of Forex Trading

- 1.5 Step 5: Develop a Trading Strategy

- 1.6 Step 6: Practice with Demo Accounts

- 1.7 Step 7: Start Trading with Real Money

- 1.8 Step 8: Continuous Learning and Improvement

- 2 End Note:

Understanding Forex Trading

Before jumping into trading forex, it’s crucial to grasp the fundamentals. Forex trading involves buying and selling currencies, aiming to profit from the changes in exchange rates. The forex market operates 24 hours a day, five days a week, and offers high liquidity and trading volume, making it one of the most accessible financial markets globally.

How to Start Forex Trading?

Step 1: Educate Yourself about Forex Markets

Begin your forex trading journey by acquiring knowledge about the intricacies of the market. Learn about major currency pairs, such as EUR/USD and GBP/USD, and understand how economic indicators, central bank policies, and geopolitical events impact currency values. Familiarize yourself with trading terminology, basic strategies, and risk management techniques.

Step 2: Choose a Reliable Forex Broker

Selecting a reputable forex broker is essential for a smooth trading experience. Look for brokers that are regulated by respected financial authorities, offer competitive spreads, provide user-friendly trading platforms, and offer reliable customer support. Research and compare different brokers to find one that aligns with your trading goals and preferences.

Step 3: Open a Trading Account

Once you’ve chosen a forex broker, it’s time to open a trading account. Complete the registration process, provide the necessary documentation for verification, and fund your account with an initial deposit. Most brokers offer different types of accounts to cater to traders with varying experience levels, so choose the account that suits your needs.

Step 4: Learn the Basics of Forex Trading

To navigate the forex market successfully, you must grasp the basics;

- Pips; the smallest price increment in forex trading

- lot sizes; volume of your trades. 4 lot sizes available are;

- Standard Lot; 100,000 units of base currency

- Mini Lot; 10,000 units

- Micro Lot; 1,000 units

- Nano Lot; 100 units

- order types; market orders, limit orders, and stop orders

Step 5: Develop a Trading Strategy

A trading strategy acts as a roadmap for your forex trading journey. Combine fundamental analysis (assessing economic indicators and news releases) with technical analysis (studying price charts, patterns, and indicators) to identify potential trade opportunities. Implement risk management techniques, such as setting stop-loss orders and determining appropriate position sizes.

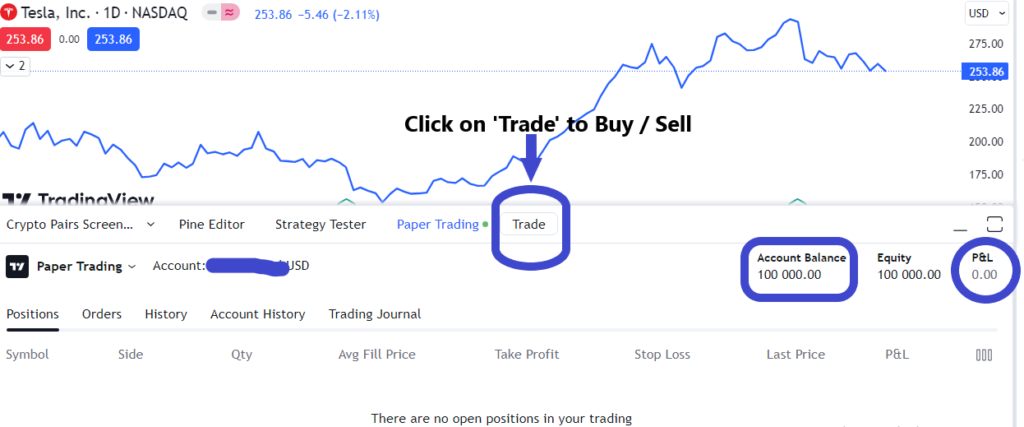

Step 6: Practice with Demo Accounts

Many forex brokers offer demo accounts, allowing you to practice trading without risking real money. Utilize this invaluable tool to familiarize yourself with the trading platform, test your strategies, and gain confidence in your trading abilities. Treat the demo account as a learning ground to refine your skills.

Step 7: Start Trading with Real Money

Once you feel comfortable and confident with your trading skills, it’s time to transition to live trading. Start small and manage your risk effectively. Set a maximum risk per trade based on your risk tolerance and account size. It’s crucial to have realistic expectations and understand that consistent profits take time to achieve.

Step 8: Continuous Learning and Improvement

Forex trading is an ongoing learning process. Stay updated with market news, economic calendars, and financial analysis reports to understand market trends and potential catalysts. Engage with other traders through online communities and forums to exchange ideas, seek advice, and gain insights from experienced traders. Regularly analyze your trades, identify strengths and weaknesses, and continuously refine your trading strategy.

End Note:

Starting your forex trading journey requires a solid understanding of the market, choosing the right broker, and developing a trading strategy that suits your goals and risk tolerance. By educating yourself, practicing with demo accounts, and gradually transitioning to live trading, you can gain valuable experience and improve your chances of success. Remember, forex trading is a journey of continuous learning, adaptability, and disciplined risk management.