Do you aspire to benefit from the high growth (~7%) of the Indian economy?

Stock market trading in India offers you the opportunity to participate in the growth of the Indian economy and potentially generate profits by buying and selling stocks of publicly listed companies. However, getting started in stock market trading can seem daunting for beginners. This article will provide you with a step-by-step guide on how to do trading in stock market in India, covering the account opening process with links to relevant websites to apply. As a bonus tip, important sources to stay informed about the Indian stock market are also mentioned.

Contents

- 1 7 Steps to Start Trading in Stock Market in India

- 1.1 Step 1: Choose a Registered Custodian Bank (for non-Indian Nationals)

- 1.2 Step 2: Complete the KYC Process

- 1.3 Step 3: Obtain a PAN Card

- 1.4 Step 4: Open a Trading and Demat Account

- 1.5 Step 5: Fund Your Trading Account

- 1.6 Step 6: Research and Select Investment Options

- 1.7 Step 7: Place Trades and Monitor Investments

- 2 Best Sources to Stay Updated on Indian Stock Market

- 3 End Note

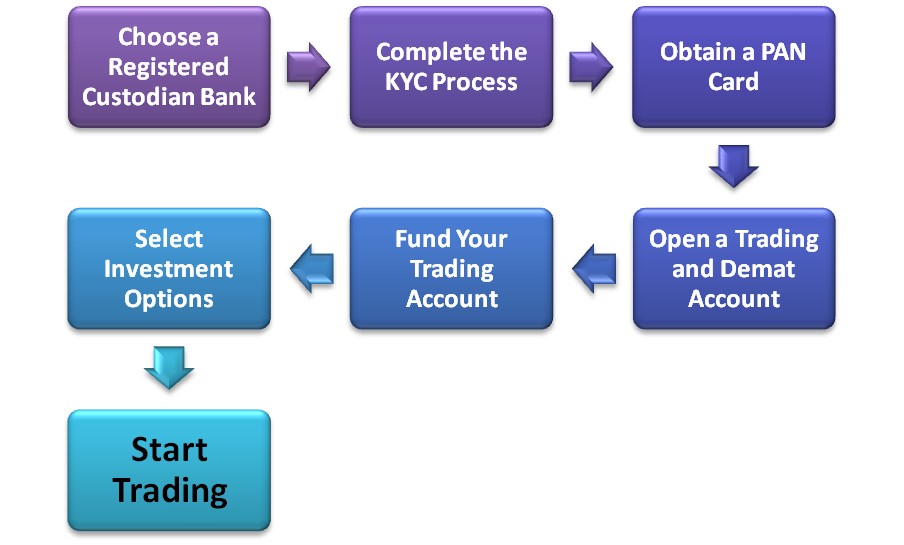

7 Steps to Start Trading in Stock Market in India

Step 1: Choose a Registered Custodian Bank (for non-Indian Nationals)

To invest in the Indian stock market, foreign nationals must open a Non-Resident External (NRE) or a Non-Resident Ordinary (NRO) account with a registered custodian bank in India. These accounts allow you to hold and transact in Indian rupees.

The most popular custodian banks in India are;

- HDFC Bank

- ICICI Bank

- Kotak Mahindra Bank

Step 2: Complete the KYC Process

As part of the Know Your Customer (KYC) process, you will need to provide necessary identification and address proof documents to the custodian bank. This includes submitting copies of your

- Passport

- Overseas address proof

- Proof of Indian visa, if applicable.

The bank will guide you through the required documentation and verification process.

For Indian nationals, you are required to submit copies of your

- PAN card

- Aadhaar card

- Passport

- Bank statement

Step 3: Obtain a PAN Card

To invest in the Indian stock market, foreigners must obtain a Permanent Account Number (PAN) card from the Indian Income Tax Department. This unique identification number is necessary for any financial transactions, including trading and investing in Indian securities.

To apply for a PAN card, visit www.pan.utiitsl.com

Step 4: Open a Trading and Demat Account

Once you have completed the KYC process and obtained a PAN card, you can open a trading and demat account with a registered stockbroker in India. The trading account allows you to place buy and sell orders, while the Demat account holds your Indian securities in electronic form.

Many Indian stock brokerage firms offer online trading platforms accessible to international investors. Here are the top 6 Indian stock brokers;

- Zerodha

- Upstox

- Angel Broking

- Sharekhan

- ICICI direct

- Groww

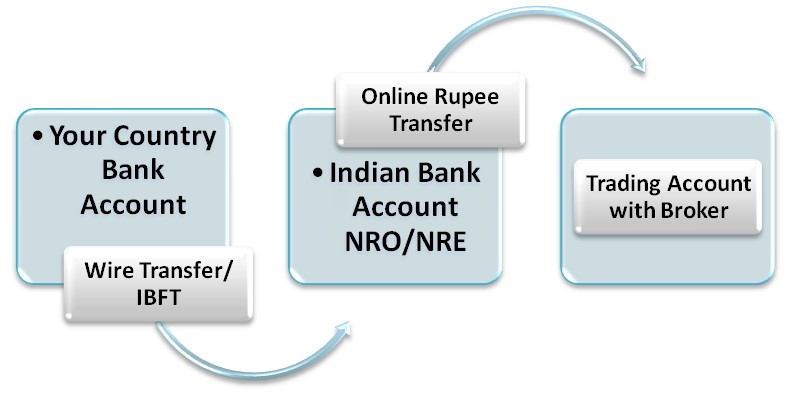

Step 5: Fund Your Trading Account

To start trading in stock market in India, you need to transfer funds from your country’s bank account to your NRE or NRO account in India. This can be done through wire transfer or other authorized channels. The funds will be converted from US dollars to Indian rupees based on prevailing exchange rates.

Step 6: Research and Select Investment Options

Conduct thorough research and analysis to identify suitable investment options in the Indian stock market. Evaluate company fundamentals, financial performance, market trends, and sector-specific opportunities. Before selecting a stock for trading in Indian stock market, always do a technical analysis of the stock chart.

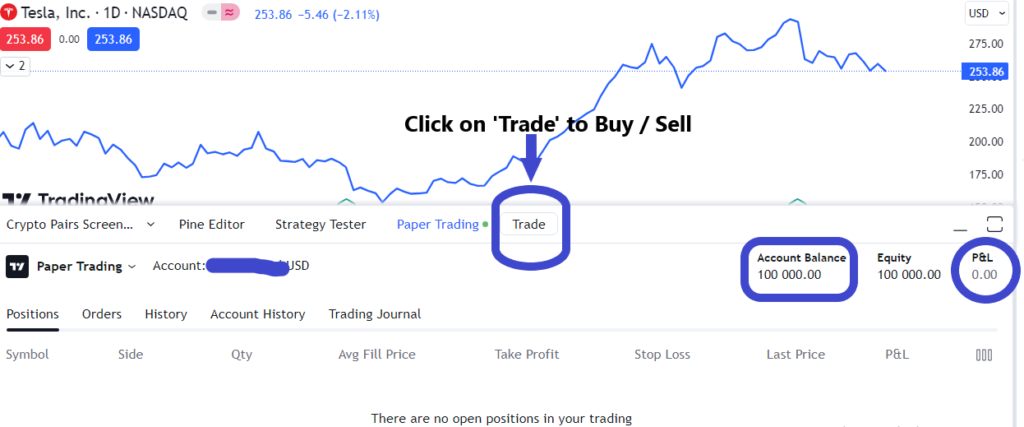

Step 7: Place Trades and Monitor Investments

Using your trading account, place buy and sell orders for the chosen securities. Monitor your investments regularly and stay informed about market news, company updates, and regulatory changes that may impact your holdings. Implement risk management strategies, such as setting stop-loss orders, to protect against significant losses.

Best Sources to Stay Updated on Indian Stock Market

The Indian stock market is dynamic and constantly evolving. Stay updated with market trends, economic indicators, and regulatory changes. Following are the popular sources of information on Indian Stock Market;

End Note

Engaging in Indian stock market trading allows you to diversify your investment portfolios and potentially benefit from India’s fast-growing economy. It is important to conduct thorough research and exercise caution while investing. With the right trading strategies and staying updated about the Indian economy, you can explore and benefit from the opportunities offered by the Indian stock market.