Robinhood has revolutionized the world of trading by providing a user-friendly platform that offers commission-free trades. This commission-free trading facility of the platform has attracted many day traders. In this article, we will explore Robinhood day trading rules, strategies, risk management techniques, psychological aspects, and useful tips that can help you succeed on this platform.

Contents

Why Robinhood Day Trading?

Day trading involves opening and closing a position within the same day. In usual day trading, traders are looking for market volatility sufficient enough to offer them profit after deducting the trading fee. Robinhood has facilitated by exempting trading fees. This commission-free nature offers traders to reap whole benefits of market volatility.

However, every trading account on Robinhood can’t do day trading, there are certain rules to follow.

Robinhood Day Trading Rules and Regulations:

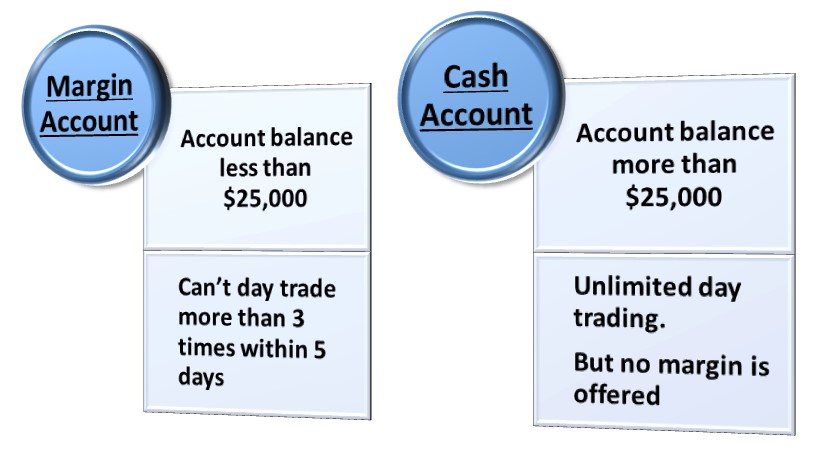

It’s important to understand Robinhood day trading rules. One such rule is the Pattern Day Trader (PDT) rule, which stipulates that accounts with less than $25,000 can execute only three-day trades within a rolling five-day period. Familiarize yourself with these regulations to ensure compliance and avoid any restrictions on your trading activities.

Account Types for Day Trading at Robinhood:

There are two types of accounts at Robinhood;

Opening a cash account at Robinhood allows you unlimited day trading. A cash account requires a minimum amount of $25,000.

Best Strategies for Robinhood Day Trading:

It involves searching for strong market sentiment and opening a very large trade position for a short period of time. Trade commission is not a problem here, so the only focus is to identify market conditions suitable for scalping.

- Momentum Trading:

It focuses on capitalizing on strong trends and market momentum. Use technical indicators like RSI, Volume, or Moving Averages to measure the momentum of an ongoing trend and ride the trend until the indicators reflect momentum fading out.

- Breakout trading:

Breakout trading involves entering trades when the price breaks through key levels of support/resistance or technical chart patterns. Construct support/resistance lines and wait for the market to break out these levels.

- Swing trading:

Swing trading aims to capture short- to medium-term price swings within an established trend. Use trading indicators (stochastic, RSI, and Bollinger bands) to spot upcoming swings for trade entries.

Risk Management for Robinhood Day Trading:

Effective risk management is essential for long-term success in day trading. Devise a robust risk management plan and stick to it. Commission-free trading may lure you into taking bigger risks but you should avoid it.

Determine an appropriate risk/reward ratio for each trade to ensure potential gains outweigh potential losses. Implement appropriate stop-loss and take-profit levels to manage risk and protect your capital. Proper position sizing and managing portfolio exposure are also crucial for minimizing risk.

Finally, avoid too large leverage in day trading. Price volatility can liquidate your position.

Psychological Aspects of Robinhood Day Trading:

Trading psychology plays a vital role in day trading success. Emotion control is crucial, as fear and greed can cloud judgment and lead to impulsive decisions. Commission-free nature of Robinhood can induce you to take a larger trade position, which in turn, magnifies emotional involvement. As a result, a trader may make irrational decisions.

In order to avoid this, develop emotional discipline and stick to your trading plan. Learn to handle the pressure and stress associated with day trading. Reduce your trading position size after a losing trade.

Maintaining a trading journal helps track your progress, identify strengths and weaknesses, and make necessary improvements.

Important Tip:

Use limit order for Robinhood Day trading. One of the revenue sources for Robinhood is ‘Market order execution at some points higher’. If you place a limit order, you will save the differential of order execution.

Concluding Remarks:

Day trading on Robinhood offers exciting opportunities for traders to actively participate in financial markets. However, it requires a combination of knowledge, technical analysis skills, discipline, and continuous learning to succeed.

Developing a robust trading strategy and practicing discipline to execute it can enable you to make a lot from commission-free trading at Robinhood. Remember, patience, practice, and perseverance are keys to becoming a successful Robinhood day trader.

FAQs:

Does Robinhood allow day trading?

Yes, Robinhood allows day trading with some specific rules.

How to day trade on Robinhood without 25k?

To day trade on Robinhood without $25k, open a “Margin Account” at Robinhood. It allows you day trading but only three trades within rolling 5 days.

How many day trades does Robinhood allow?

Robinhood allows only three-day trades (for rolling 5 days) for account balances below $25,000. For accounts above $25k, you can do an unlimited number of trades in a day.

How does Robinhood’s 24-hour trading work?

Robinhood 24-hour trading works by setting a price limit or time limit to execute a trade. For example, you set a limit price for a trade i.e. maximum price at which you are willing to buy or the minimum price at which you are willing to sell. Otherwise, you can set a time at which your trade should be executed.

What is Robinhood day trading fees?

Robinhood does not charge any fee for day trading. The only requirement is to have an account balance above $25,000.

What happens if you are market ‘Pattern Day Trader’ on Robinhood?

Robinhood restricts you to only three-day trades for rolling 5 days. Otherwise, you have to maintain an account balance of $25,000.

Why do you need 25k to day trade at Robinhood?

It’s Robinhood’s rule to have an account above $25k if you want to do an unlimited number of trades in a day. Robinhood allows only three-day trades (for rolling 5 days) for account balances below $25,000.

An outstanding share! I have just forwarded this

onto a coworker who has been conducting a little research on this.

And he actually bought me breakfast simply

because I discovered it for him… lol. So allow me to reword

this…. Thanks for the meal!! But yeah, thanks for spending time to discuss this issue here on your web site.