Are you perturbed by the loss due to overnight price changes after fundamental news? Or do you aspire to cash the price volatility within a day?

Day trading is the appropriate strategy for you!

It is an exciting and potentially lucrative venture that allows you to buy and sell financial instruments within the same trading day. While it offers the opportunity for quick profits, it also carries significant risks.

In this article, we will delve into the essential aspects of day trading, providing beginners with a solid foundation to embark on their trading journey.

Contents

What is Day Trading?

Day trading refers to the buying and selling of financial assets (stocks, currencies, or commodities) within the same day. Unlike long-term investing, day traders aim to capitalize on intraday price movements and close all their positions before the trading session ends.

Risk Factor in Day Trading:

A greater risk is involved in day trading as the uncertain market moves during a day invite greater emotional involvement. This emotional involvement hinders rational decision-making and thus pushes a trader towards hunch/bad trades.

Pros & Cons of Day Trading:

Essential Steps for Successful Day Trading:

Step 1: Understanding Market Basics:

Before diving into day trading, it is essential to familiarize yourself with the basics of the financial markets. Learn about different asset classes (stocks, crypto, forex), market dynamics, and key trading terminology. Building a strong foundation of market knowledge will help you make informed trading decisions.

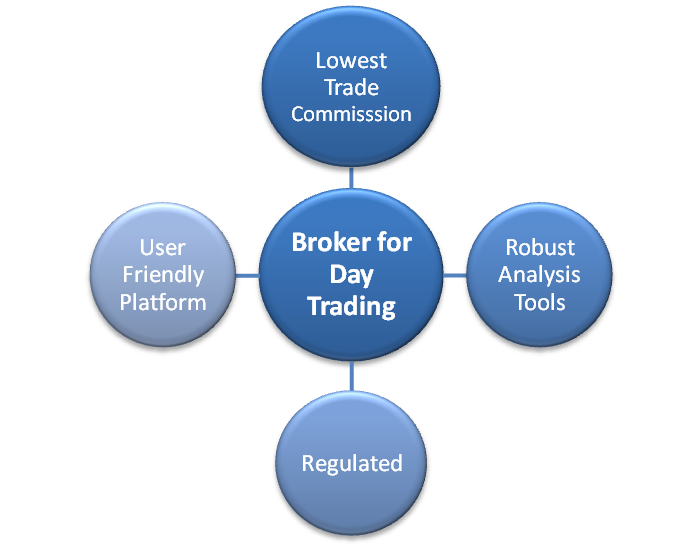

Step 2: Choosing a Reliable Broker:

Selecting a trustworthy broker offering the lowest trade commission is a pivotal step in your day trading success.

Step 3: Developing a Robust Day Trading Strategy:

You must develop a robust strategy for day trading. Some of the popular day trading strategies are;

- Trend Following

- Range Trading

- Scalping

- Swing Trading

Step 4: Analyzing Market for Day Trading:

The most crucial step that determines the success of a day trader is market analysis skills. There are two types of market analysis;

- Technical Analysis:

Technical analysis involves analyzing intraday price charts to identify market trend and price patterns. Learn to read candlestick charts, recognize support and resistance levels, and utilize popular technical indicators like moving averages or the Relative Strength Index (RSI).

Technical analysis enables you to decide potential entry and exit points for your trades.

- Fundamental Analysis:

While day trading primarily focuses on short-term price movements, understanding fundamental factors that can impact asset prices is also essential. Stay updated on relevant news, economic releases, and company earnings reports. Fundamental analysis helps you identify catalysts that may drive significant price movements.

Step 5: Risk Management:

Keep risk to reward ratio 1 to 3 and always put stop loss order. Implementing stop-loss orders is crucial to manage risk in day trading. A stop-loss order automatically closes your position if the price reaches a predetermined level, limiting potential losses. Determine your stop loss level based on your risk tolerance and the volatility of the asset being traded.

Most Important Elements for Day Trading:

- Embracing Emotional Discipline in Day Trading:

Emotions can be a day trader’s worst enemy. Fear and greed can cloud judgment and lead to impulsive and irrational decisions. Develop emotional discipline by sticking to your trading plan, avoiding impulsive trades, and not letting emotions dictate your actions.

- Practice and Continual Learning:

Day trading is a skill that requires practice and ongoing education. Utilize demo accounts provided by brokers to practice your strategies without risking real money. Take advantage of educational resources, attend webinars, read books, and follow experienced traders to expand your knowledge and refine your skills.

Special Tips for Day Trading:

- Limit your account leverage below 10% to avoid the risk of liquidation.

- Avoid over-trading.

- Keep an eye on upcoming news and events during the day.

End Note:

Day trading can offer exciting opportunities for beginners, but it requires dedication, discipline, and continuous learning. By understanding the basics of day trading, developing a solid trading strategy, managing risks effectively, and embracing emotional discipline, beginners can increase their chances of success in this dynamic market.

Frequently Asked Questions (FAQs)

Is day trading profitable for beginners?

If a day trader develops a robust trading strategy and embraces emotional discipline, day trading can be profitable.

Can I make $100 a day from day trading?

By choosing a trading instrument having reasonable volatility, and developing a solid trading strategy and risk management plan, you can definitely make $100 a day from day trading.

How do I start day trading as a beginner?

As a beginner, you can start day trading by following 5 steps; understanding market basics, open account with a reliable broker, market analysis, and developing trading strategy and risk management plan.

How much money do I need to start day trading?

The minimum capital required for day trading varies depending on the broker and the markets you wish to trade. However, it is generally recommended to have a sufficient amount of capital to manage risks effectively.

Can I day trade with a full-time job?

Day trading requires active monitoring of the markets, which can be challenging with a full-time job. However, some traders manage to balance both by utilizing technology, setting specific trading hours, and automating certain aspects of their trading strategy.

Are there any guarantees of making profits in day trading?

No, there are no guarantees of making profits in day trading. The markets are inherently unpredictable, and losses are a possibility. It is essential to approach day trading with realistic expectations and a focus on risk management.

Day trading is definitely an exciting venture for beginners! Understanding the basics, developing a strategy, and managing risks are key steps to success. However, I’m curious about how beginner traders can effectively handle emotional discipline. Do you have any tips or techniques to share on how to keep emotions in check while day trading? 🤔

For effective emotional handling in day trading;

1. Develop a robust trading plan/strategy after thorough trials

2. Stick to your plan whatever happens

3. Reduce your trading position size in the beginning

I’ll share a detailed post on trading psychology of day trading & how to master it. Stay connected.