Are you struggling to find appropriate stocks for swing trading?

Choosing the right stock plays a pivotal role in successful swing trading. This article enlists the best stocks for swing trading in 2024 and explores why these stocks are suitable for this trading approach.

Contents

Factors to Consider when Selecting Stocks for Swing Trading

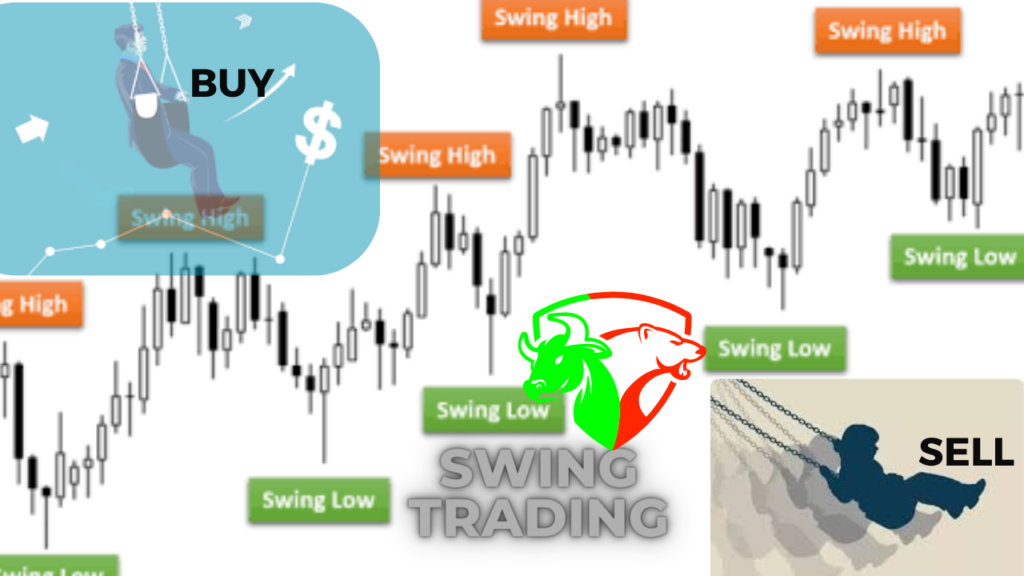

Swing trading is a popular trading strategy that involves holding positions for short to medium-term durations to capitalize on price swings in the financial markets. Here are some key factors to consider while choosing the stocks for successful swing trading:

- Volatility: Volatility is a prerequisite for swing trading stocks. Stocks with sufficient price volatility offer better opportunities for riding price swings.

- Liquidity: High trading volume ensures that swing traders can easily enter and exit positions without significantly impacting the stock’s price.

- Catalysts and Events: Stocks with upcoming news events, earnings reports, or product launches may experience significant price swings.

- Technical Analysis: Analyzing price charts and technical indicators helps identify potential entry and exit points. Swing trading stocks should observe principles of technical analysis.

Top Stocks for Swing Trading in 2024

Described below is a list of top swing trading stocks from the NYSE:

Technology Sector

- Apple Inc. (AAPL): Apple is a leading technology company known for its innovative products. The stock often experiences significant price swings, making it attractive for swing trading.

- Microsoft Corporation (MSFT): As one of the world’s largest tech companies, Microsoft’s stock is actively traded, offering ample opportunities for swing trading.

Consumer Discretionary Sector

- Amazon.com Inc. (AMZN): Amazon’s stock is known for its price volatility, driven by factors such as e-commerce trends and product launches.

- Nike Inc. (NKE): As a well-established consumer discretionary company, Nike’s stock can see notable price movements during product releases and market trends.

Healthcare Sector

- Johnson & Johnson (JNJ): Johnson & Johnson is a stable healthcare company, but it occasionally experiences price swings due to market events and product developments.

Financial Sector

- JPMorgan Chase & Co. (JPM): JPMorgan Chase is a leading financial institution, and its stock can experience significant price fluctuations in response to economic events.

Energy Sector

- Exxon Mobil Corporation (XOM): The energy sector often sees price swings due to geopolitical events and oil price fluctuations, making XOM the best stock for swing trading.

Communication Services Sector

- Alphabet Inc. (GOOGL): Google’s parent company, Alphabet, is a highly traded stock with significant intraday price movements, attracting swing traders.

Industrials Sector

- Boeing Co. (BA): Boeing’s stock can experience notable price swings influenced by developments in the aviation industry and global events.

Risk Management in Swing Trading

While swing trading can be profitable, it involves inherent risks. To manage risk effectively, you should:

- Use stop-loss orders to limit potential losses.

- Avoid overtrading and stick to a disciplined trading plan.

- Manage position sizes based on risk tolerance.

Conclusion

Swing trading is a dynamic strategy that offers you exciting opportunities to profit from short to medium-term price movements. By selecting the right stocks for swing trading and efficiently executing the right swing trading strategy, you can potentially achieve your financial goals in 2024. Last but not least, never forget to place appropriate stop loss for swing trading.