Are you struggling to find the right trading approach? Swing trading and day trading offer two distinct approaches; each with its thrills and challenges. This article presents a detailed comparison of swing trading vs day trading guiding you to make an informed decision in choosing the right trading approach that best aligns with your goals and preferences. It describes the key differences between swing trading and day trading, their advantages and disadvantages, trading strategies for both styles, risk factors and psychological aspects of each style.

Contents

- 1 What is Swing Trading?

- 2 What is Day Trading?

- 3 Key Differences between Swing Trading and Day Trading

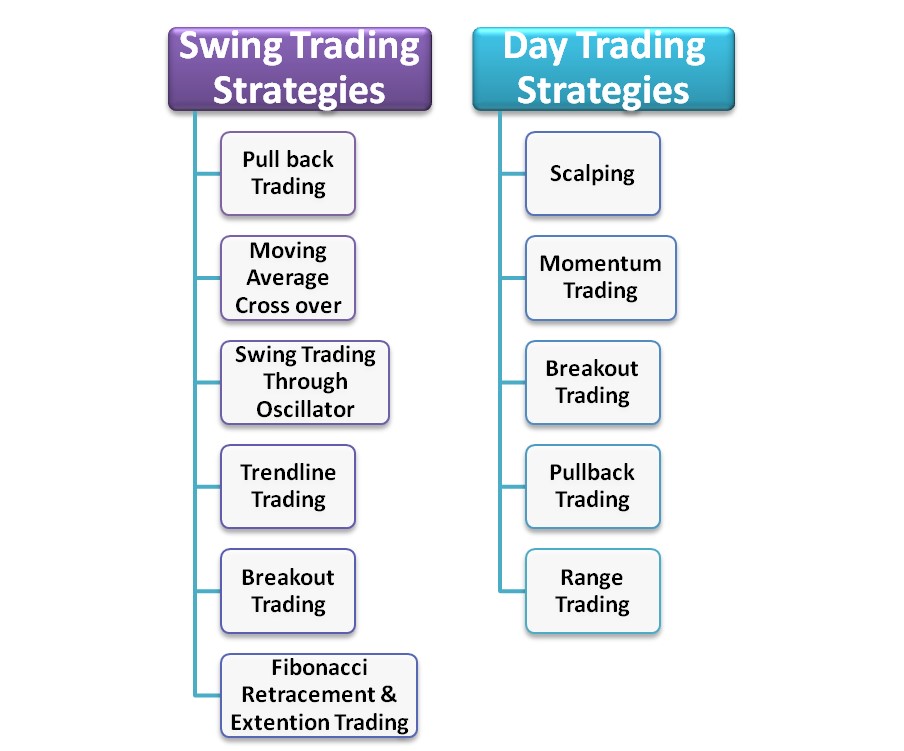

- 4 Strategies for Swing Trading and Day Trading:

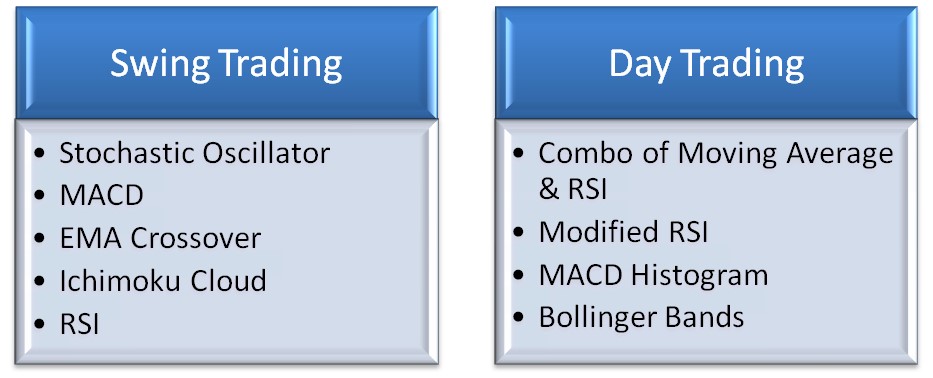

- 5 Technical Indicators for Swing Trading vs Day Trading:

- 6 Psychology of Swing Trading vs Day Trading:

- 7 Risk Factor in Day Trading vs Swing Trading:

- 8 Which Trading Style is Right for You?

- 9 Conclusion

What is Swing Trading?

Swing trading involves holding positions for several days to weeks to capitalize on short to medium-term price movements. Swing traders use technical analysis, chart patterns, and market trends to identify potential entry and exit points.

Advantages:

- Allows traders to capture larger price movements compared to day trading.

- Does not require constant monitoring of the markets throughout the day.

- Provides the opportunity to benefit from both uptrends and downtrends.

Disadvantages:

- Holding positions overnight exposes traders to overnight market risks.

- Requires patience and discipline to hold positions for extended periods.

- This may lead to missing out on intraday opportunities.

What is Day Trading?

Day trading involves opening and closing positions within the same trading day, with no positions held overnight. Day traders use technical analysis, level 2 quotes, and real-time data to make quick trading decisions.

Advantages:

- Avoids overnight market risks since all positions are closed by the end of the day.

- Allows traders to capitalize on intraday price movements and quick profits.

- Provides more opportunities for active traders throughout the day.

Disadvantages:

- Requires constant attention to the markets during trading hours.

- This may lead to higher transaction costs due to frequent trading.

- Can be mentally and emotionally demanding, especially during volatile market conditions.

Key Differences between Swing Trading and Day Trading

1. Holding Period

The primary difference between swing trading and day trading is the holding period of positions. Swing traders typically hold positions for several days to weeks, while day traders exit all positions by the end of the trading day.

2. Risk and Reward

Swing trading generally involves larger risk and reward potential compared to day trading. Since swing traders aim for bigger price movements, they also face higher risks, including overnight market gaps. On the other hand, day traders seek smaller, more frequent gains, leading to lower potential risk but also lower potential rewards.

3. Time Commitment

Day trading demands more time and attention throughout the trading day. Day traders must closely monitor the markets, execute trades quickly, and stay updated with real-time information. Swing trading requires less time commitment, as positions are held for more extended periods.

4. Trading Styles

Swing trading and day trading also differ in their trading styles. Swing traders focus on identifying trends and capturing significant price moves, while day traders thrive on short-term price fluctuations, making multiple trades in a single day.

Strategies for Swing Trading and Day Trading:

Technical Indicators for Swing Trading vs Day Trading:

Psychology of Swing Trading vs Day Trading:

In day trading, greater emotional strain is involved which increases the chances of emotional decision making or hunch trading. On the other hand, swing trading requires careful analysis to identify a price swing, so greater probability of a rational decision. However, when a swing trade goes in significant profit or loss, greed may prevent booking the loss or profit.

So strictly sticking to a trading plan can foster the right mindset for both swing trading as well as day trading.

Risk Factor in Day Trading vs Swing Trading:

A greater risk of loss is present in swing trading where overnight fundamental changes may hit an ongoing swing trade. No such overnight risk of loss is involved in day trading.

However, day trading involves trading on smaller duration charts where market randomness and noise increase. This may enhance the frequency of losing trades. So a beginner may face more risk/loss factor in day trading.

Which Trading Style is Right for You?

After going through a detailed comparison of swing trading vs day trading, the next step is to decide which one is better for you.

Factors to Consider

When deciding between swing trading and day trading, consider the following factors:

- Risk Tolerance: Assess your comfort level with overnight risks and frequent intraday trading.

- Time Availability: Determine how much time you can dedicate to monitoring the markets and executing trades.

- Capital Size: Consider the amount of capital you have for trading, as different styles have varying capital requirements.

- Personal Preferences and Goals: Choose a trading style that aligns with your personal preferences and financial goals. If you prefer a less intense and more relaxed approach, swing trading may be suitable. On the other hand, if you thrive on quick decisions and prefer shorter holding periods, day trading might be a better fit.

Which is best for a Beginner; Swing Trading or Day Trading?

Swing trading is best for beginners due to two reasons;

1) Lesser emotional involvement.

2) Enhanced accuracy of chart technical analysis at longer time frames.

Conclusion

Swing trading and day trading offer unique opportunities and challenges for traders. Understanding the differences between these two styles can help you make an informed decision based on your risk tolerance, time availability, and financial objectives. You prefer capturing big price moves or relish the rush of quick profits – the choice is yours! Whichever style you choose, remember that successful trading requires discipline, continuous learning, and effective risk management.