Quick view of GBPUSD currency pair suggests a bullish trend prevails but details technical analysis reflects that a downtrend may be on the horizon. Examining the price chart reveals three key signs that indicate a potential reversal in the pair’s direction.

Contents

1. Rising Wedge Pattern:

A rising wedge pattern is formed in 1d chart of GBPUSD. The rising wedge is a bearish pattern and usually forms at an important reversal or top.

The rising wedge formed in the GBP chart is shown in the figure below;

After its downward breakout, the price will rush to the lowest point of the wedge i.e. 1.2549.

2. Bearish Divergence in RSI:

Another strong bearish reversal sign is the formation of bearish divergence in the Relative Strength Index (RSI). As prices have climbed higher, the RSI, a momentum oscillator, has failed to mirror this upward trajectory. A bearish divergence occurs when the price forms higher highs while the RSI forms lower highs, indicating weakening bullish momentum. This disparity between price action and momentum is a classic warning sign that a correction or reversal may be imminent.

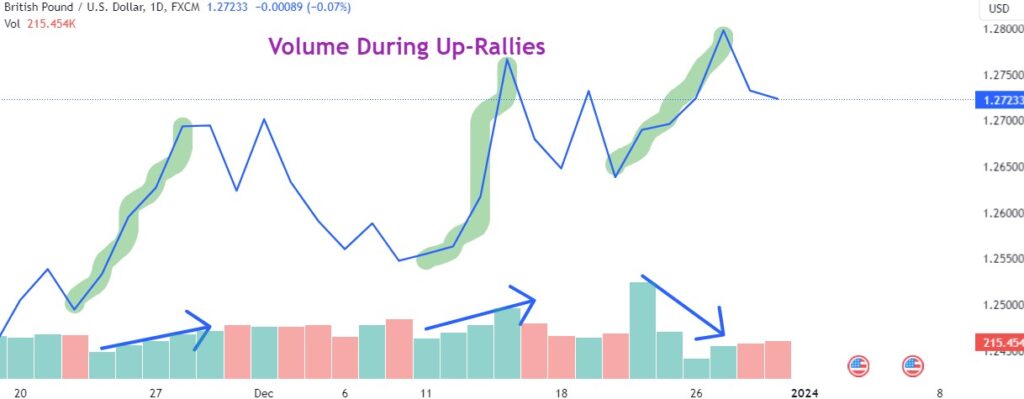

3. Volume Analysis Suggests Bulls are exhausted:

The figure below shows the volume trend of the last three price rallies in the GB pound. In the first and second price rallies, trading volume increases with the unfolding of the rally. However, in the third price rally of GBPUSD, trading volume decreased as the trend proceeded. It reflects lesser number of traders are interested in buying GB pound at this price level.

So exhausting bulls suggest that the uptrend is near to peaking and subsequently downtrend may proceed.

End Note:

In summary, the technical analysis of the GBPUSD price chart reveals three significant signs pointing towards a potential downtrend. The rising wedge pattern, bearish divergence in the RSI, and declining volume during the recent price rally collectively suggest that you should exercise caution. While technical analysis provides valuable insights, it’s important to note that market conditions can change rapidly, and you should employ risk management strategies to navigate potential shifts in the forex landscape.