Entering the world of stock market trading can be an exciting and potentially rewarding endeavor. However, for beginners, the complexities of the stock market can seem overwhelming. This article provides a comprehensive guide to stock market trading for beginners, covering key concepts, essential steps, key market drivers, factors affecting market performance, and valuable tips to help you embark on your trading journey with confidence.

Contents

Understanding Working of the Stock Market:

Stock market is a place where listed companies sell their shares at the quoted price. For the first time, companies sell their shares in an Initial Public Offering (IPO) at a specific price. After that, the shares are sold at a price where consensus takes place among buyers and sellers. The seller places an order at a certain price called ‘Ask Price’ whereas the buyer places an order called ‘Bid Price’. Once Ask and Bid prices match, the order is executed.

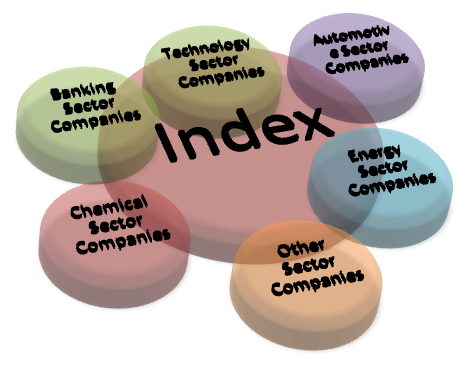

What is the stock market Index?

In the stock market, companies are categorized into various sectors like Technology, Energy, Chemical, Automotive etc. For measuring the overall performance of the stock market, the market index is formed by allocating weighted averages to certain biggest companies in each sector. For example, DJ30 is an index comprising 30 prominent companies of the NYSE with each company carrying its weightage as per its market capitalization.

Factors Affecting Market Performance:

There are two types of factors affecting the stock market;

- Major Variables; Global business environment, price of commodities & raw materials, Global Politics.

- Minor Variables; Interest Rates, Domestic Growth Rate, Government policies, political stability, and trade agreements.

Order Types in Trading:

- Market Order; The order is executed at any price available in the market.

- Limit Order; Executed at a specific price.

- Stop Order; Close position at mentioned price.

- Trailing Stop Order; If the market goes in favor, revise the stop loss step by step.

3 Essential Steps for Trading at Stock Market:

Step 1 Opening a Trading Account:

To start trading in the equity market, you will need to open a trading account with a brokerage firm. Research different brokerage options and compare their fees, trading platforms, research tools, and customer support. Consider factors such as ease of use, educational resources, and the availability of mobile trading apps. Once you select a brokerage, complete the account opening process by providing the necessary documents and funding your account.

Step 2 Market Analysis:

Before buying or selling equity, the market is analyzed for its trend direction. There are two types of stock market analysis; Fundamental analysis and technical analysis. Fundamental analysis refers to studying details of company management, business profile, profitability, growth trend, product demand, and competitors in the market. Technical analysis deals with reading a company price chart to predict its future price trend.

Step 3 Developing a Trading Plan:

A trading plan is a crucial step for success in equity market trading. It includes your trading goals, preferred trading style (such as day trading or swing trading), and time commitment. A trade plan clearly defines trade entry and exit criteria based on your analysis and risk management principles. Mention the maximum amount of capital you are willing to risk per trade and set profit targets and stop-loss levels to manage your trades effectively.

Various Players in the Stock Market:

Banks, Mutual Funds, Investment Companies, Foreign Companies, High Networth Individual Investors, Insurance Companies, Individual investors, and Corporations.

Who Drives Stock Market Up or Down:

Sentiment drives the stock market. The majority’s thinking about the market forms market sentiment. If the majority of market participants think that business conditions are favorable and start buying, then bullish sentiment prevails in the market. Conversely, if more traders start selling, then the market starts sliding down and is termed a bearish sentiment.

Apart from sentiment government budget policies, business cycles, crop season and company results also drive the stock market.

Importance of “News”:

News is important in the market as it may alter sentiment about the market or a stock. However, a beginner trader should avoid news-based trading because news reaches the individual traders after all the corporate sector who has already acted according to the news. Further, many news are just speculations about certain stocks.

Investing vs. Trading:

Investing refers to buying shares and holding over a long period, say, a few years. In trading, the holding duration is shorter from a few days to hours or minutes.

Tips vs. Own working for Trading:

Trading tips are quite attractive get-rich-quick recipes for beginner traders. Some of the tips may turn out right but in the long term, trading tips cost a lot. Not only does a trader get stuck in wrong trades but his learning trajectory also gets destroyed. So one must learn to do paper trading and enter the stock market after proper working.

Return to be expected:

Some social media stories portray the stock market as a place for making millions over the night. In reality, this is not true. The stock market has the potential to return two to threefold over a decade if an investment is made after proper working i.e. investment at the right price level and in high-growth companies.

However, if someone invests just for dividend return, then the return amounts to 3%-10% per year depending on the companies selected.

Risk Factor in Stock Trading:

The stock market is highly volatile in nature, so it poses a greater risk to capital. A beginner should allocate a small portion of your capital to stock market trading. You must decide your risk appetite i.e. amount of money you are willing to lose against a certain return. To protect your capital, always place strict stop loss whenever you enter a trade.

Further, avoid leveraging the account in the beginning as greater leverage may lead to your account liquidation if the market goes against your perceived direction.

End Note:

Stock market is a risky venture especially if you are new to the market. Focus on learning because learning is half-earning in the stock market. Mastering market analysis skills and developing robust trading psychology can enable you to earn a handsome return from the stock market.